Tag Archives: Medicare

Every Senior citizen is entitled to health insurance which covers their expenses up into a particular limit. But dependent in their requirement they might need to just take precisely the same treatment multiple days at the past and thus they must bear the costs of the own after the top cap has been surpassed. However, it is not anything to presume very seriously since there really are Medicare supplement plans 2020that may pay for up those additional costs and aid the senior citizens in leading their dream post-retirement lives.

However, they frequently come up with the issue of picking out the brand and package with this program. The report discusses further on this topic.

Choosing the best

Even the Next are a few of the pivotal facets which will need to get considered to make the smartest choice out of this sea of very similar choices obtainable:

· Range of senior customers handled with the service and also their reviews around the total services Provided by these beneath these plans

· Fully customized plans That May accommodate Each One of the requests of their insurance company and may thus turn useful for them at the pressing scenarios

·

The Sort of tie-ups that they have with the hospitals to Create the cost retrieval procedure easy, rather than needing to operate quite often

· The superior charged by the bureau to get these programs and if it is cheap to your pocket of the insurer

· The hassle-free registration process to your Medicare supplement plans 2020 and much easier process of having the reimbursements back

So, Keeping the longterm benefits under thought, the older era persons must proceed to the best supplement plans. In a few cases, they may locate the premium to be a bit higher, but the yields they would get from it is well worth the expenditure. Therefore think very well before choosing on any strategy.

Medicare Supplement plans really are Actually relief bundles which come to your rescue when it is needed. Every man or woman living this lifetime, need to see hospital lots of occasions in his life for unique explanations. It might be an easy disorder or any complicated disease which has to be treated with almost any operation. In every case, you have to pay for a call to some medical facility. If you’re a very high recognized particular person, you might pay for it but if you’re a middle-class man like the majority of the population, and that you don’t possess some plan like Medicare Supplement Plan G, this lone visit can be quite expensive for you personally and certainly will disturb whole of your finances. So, as a way to prevent that you must buy a Medicare Supplement program which include different plans which range from Plan G Medicare to program A, plan B, program F etc..

Great Things about These programs

These plans protect you out of your Shock you get, once you are discharged from any hospital after recovery and the hospital services charge isplaced before you. This is sometimes so high that you can have to empty your entire banking accounts. This could be the critical time if supplement plans like Medicare Plan G visit your rescue and rescue from a exact high rough hospital bill. Plan G Medicare may additionally cover most of your inpatient and psychiatric expenses which can run you a big sum, but in the event you don’t own a nutritional supplement plan to supply support for your requirements personally.

Medicare part G and trips for shopping

Introduction

In Contrast to the original Medicare prepare, and it is a government-sponsored, Medicare Part G is bought or given by private businesses or individual providers. To get a Medicare supplement prepare G, you must first have the initial Medicare program. Medicare’s original plans comprise of a part A and Medicare part G also. Many individual businesses provide Medicare part G plans. That means, locating a suitable one isn’t so straightforward. To help you keep effectively, here Are a Few of the Recommendations That You May use

Use of authorities Comparison gear

Instead of squandering some time Attempting to review the Medicare part G most by yourself, it’s better for those who employed Medicare govt comparison programs to get the exact same. When you are shopping around, you need to consider carefully your current insurance plan costs per thirty day period, your health requirements and how much you are able to easily manage.

Contact insurance Businesses

Still another Acceptable Means to Make certain you have exactly the ideal insurance policies or Medicare part G coverage is by way of calling insurance companies. It is possible to start with insurance companies that are recommended by your friends, coworkers or your relatives. You are able to ask for quotes for Medicare part G insurance policies and also have if they offer discounts on the same.

Use your condition Insurance department

Besides only Calling a insurance policy carrier right away, you may employ a state insurance department as well. This will allow you to realize the listing of complaints that are listed contrary to different insurance businesses. This can aid weed out organizations.

Medicare part G to safeguard your Life

Medicare Supplementinsurance strategy G rewards are basically the same compared to theMedigap program F, even with the exclusion. The deductible of Medicare Part B, insured below the Medigap program C and F, should be paid out out-of-the-pocket in Medicare Plan G. After the out-of-the-pocket expenses hit Role B Risk total, you eventually become answerable for paying 20 percent of some total cost of the Medicare-approved Plan B providers.

Medicare Plan G Essential benefits

Medicare Supplement Strategy G usually Incorporate the Subsequent benefits:

Part A hospice coinsurance and hospice costs around annually after the Original Medicare benefits are drained

Role A hospital caution copayment or coinsurance

Deductible: Component A

Component B medical maintenance Co-insurance

Element B copayment or coinsurance

Part B extra charges

First 3 pints of their bloodstream to the medical process

Skilled nursing facility care coinsurance attention

Constrained remote travel back-up healthcare

Most Medicare Supplement plans do not pay part B extra costs. All these are more costs which are outside a Medicare-permitted charge. For example, Medicare is allowed to charge for its appointment of their physician which may possibly be 100 bucks, but the medic could go on toopt maybe not to take that volume, also consequently bill an extra 15% to get an appointment.

Sum Upward

Here, In this case, f Medicare will proceed onto pay for 80 per cent of their granted charge, sending a doctor 80 dollars. The receiver is accountable for having to pay maybe not just the rest 20 dollars, however, also the additional 15 percentage charge, another 15 dollars, making the amount payable price 3-5 dollars. Medicare Plan G addresses this additional charge.

No matter if you’re simply 65 decades old or having a Medicare Plan, it’s the best moment to opt for your best Medicare supplement plans 2021 and for lots of very good explanations. With the greatest supplemental plans once can conserve cash and receive the very best policy which are not offered with their original Medicare Plan.

Around 10 million individuals of Medicare Program have been covered by the Supplement Plan. These varieties of strategies may also be called Medigap program plus additionally helps within the high priced discuss of costs which aren’t correlated with your original Medicare prepare, such as coinsurance, deductibles and co payments. Together with Medicare programs you can simply acquire 80% policy of their entire invoices and also the remaining 20% is required to be paid in full by the contributor from their pocket. So, to pay those 20% added expenses the Medicare Supplement Plans 2021 are already introduced. It insures the extra expenses also prevents you to payout of your pocket expenditure on medical invoices.

What exactly are Medicare Supplement Plans 2021?

Medicare Supplement Plans 2021 is your supplemental Plan Which covers most the Out-of-pocket costs and charges that are not covered by your existing Medicare approach. This includes the co payments, coinsurance along with the statute of Component One and Part B. The main reason why it is popular today between the Medicare prepare subscribers is the fact that it safeguards the policyholder from all of the out-of-pocket charges.

This supplementary strategy Provides reassurance when visiting medical Facility for treatment using less dollars in pocket. It’s the finest supplemental program that allows you to see health care without worrying about the excess costs. Besides, it also insures the overseas crisis travel to get medical treatment beyond the nation. That you don’t have to be worried about the health care cure cost outside the nation as it is insured by the supplemental program.

The risk of disorders increases in the old Accendo Medicare Supplement plans age; therefore, Men and women try to find Accendo Medicare Supplement plans to cover their medical needs. We’re likely to discuss all these health plans in this article.

Shields people in older era

These health programs Will protect you from fatal Diseases from the old age. If you are concerned about the money for financing your treatments, if you subscribe to a reliable health plan, you’ll receive your prescription drugs on time. Sometimes the worries due to health problems leads to serious issues; but when you have subscribed to such health programs, then you have no some stress on your life.

It insures your demands

These wellness plans insure the Allimportant demands of the People. Make certain you are scrutinizing your quality of life plan, everyone needs their particular health needs, as well as also the typical plans supplied by your wellness plans mightn’t insure your needs. These health plans are all crucial particularly for the people confronting critical wants, plus so they should pay a visit to the hospital every now and then, they ought to register to such wellness programs to ensure their wellbeing bills are paid on time.

These programs are cheap

The good Thing Regarding These Wellness plans is They tend to be Affordable for aged patients. The visits for the hospital grow from the older age, that the young adults should perhaps not subscribe to all these health plans, even if they do, they should get policy to the particular wellness condition which they are facing. Complete coverage would charge them a lot.

It is also Wise to get Assistance from your Physician Before becoming a member of all these wellness ideas, your family doctor knows about the health issues confronted by you along with your family and might assist you to locate the optimal/optimally health approach in the market. You should start looking for the optimal/optimally therapy, even supposing it’s high priced.

A few People are too Medicare advantage plans 2021 involved in different facets of existence that they unambiguously overlook about a few fiscal decisions that are definitely must take. We find yourself so busy in our lives that we hardly ever look at certain factors that might greatly reduce our weight. One particular such aspect will be that a individual medicare advantage program 2021. Even when you are financially feeble or powering, you might find this insurance policy effortlessly, as it is the most inexpensive plan .

Exactly how is this insurance Program, useful For all you ?

To get All the senior citizens around the world, that live off the pension that they get, you has to be facing a good deal of difficulty needing to pay off large medical expenses and drugs. It can get overwhelming sometimes. So, one of the wise decisions is to get the insurance coverage that just insures a little portion of your monthly revenue, however, helps you in various ways. It includes inpatient and out patient treatment, ambulance solutions, ER visits prescription drugs, surgeries, clinical tests, and a great deal more. You receive a number of benefits out of this.

In case Your current strategy is expiring, then this might be actually the very best choice you may acquire. Along with the root medical assistance, you get lots of amounts of health policy which could cost you a fortune if you don’t get exactly the insurance.

So, Try out the individual medicare advantage plan 2021 today!

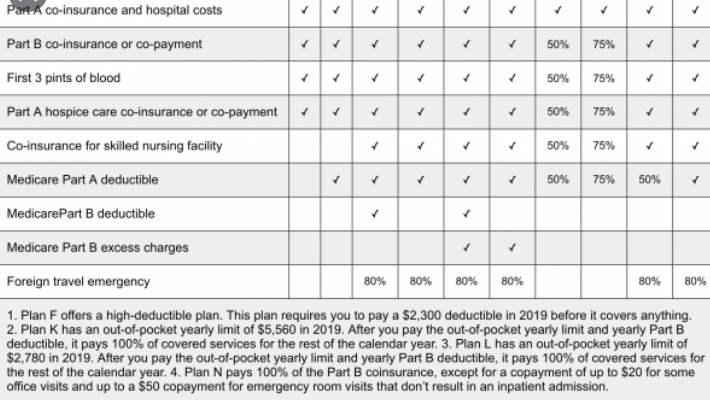

Medigap programs possess the equivalent normalized. This Suggests the important advantages of Compare Medicare Supplement plans Strategy A, for example, it’s very same above each insurance bureau which vends Strategy A by paying little attention to the area. It makes it simple to check at Medicare Supplement ideas as the key contrast between aims of the similar letter classification is going to be the elite price tag. You can Compare Medicare Supplement programs using a comparison chart.

Matters to know about Medicare supplement plan F and C

You Will Probably be Not Able to Obtain those Plans if you fit the bill for Medicare on or later January 1, 2020. That incorporates prepare F which is high-deductible. For those who as of have one of these plans, you may not need to give it. You might have the choice to buy strategy G at 2020 that can be also a high-deductible Medicare health supplement, as signaled by America’s Health Insurance options. However, it will not Cover the allowance of Medicare Part B.

Subsequent to the OOP limitation Is Finished after Plans L or K, the Medigap health supplement pays one hundred percent of Medicare-secured administrations for the rest of the schedule 12 months. The program N pays a hundred per cent of the Medicare Part B prices, aside from a copayment of $20 for virtually practice visits and also equal to $50 for emergency excursions that do not bring about the receiver being surrendered by means of an inpatient. For more information concerning these programs try to Seek the Advice of the chart as it will allow you to Review Medicare Supplement programs

Ultimate Phrases

Necessary Crisis Care in almost any Foreign Country Give you the coverage to this level perhaps not secured by Medicare for 80% of those charged charges for Medicare-qualified prices for past-due visits, doctor and clinical concern got at an remote nation, that maintenance might have been procured by Medicare whenever granted at the usa and which care started throughout the initial 60 straight back to back times of every excursion away from the United States

Medicare supplement plan G could be your health insurance policy that the pay the complete price tag of out of pocket Medicare bills, including co-insurance, co payments and extra charges. This insurance plan offers optional health policy which can be added to the original Medicare plan insurance. In general, the insurance plan G packs much more of their expenses than other supplement plan types. Therefore, it gets the greater top which you will need to pay for to avail the additional coverage.

Personal insurance firms Presenting Plan G Medicare could set their own premiums, however, the plan will stay standard offering precisely the same policy for example others. A few of the businesses also provide added advantages for Medicare Part G plans.

Which are the Protection of Medicare Supplement Plan G?

With Medicare Supplement Plan G insurance one can delight in the next coverage.

• A Medical Facility Co Insurance and costs up to one year after the Original Medicare drained

• Hospice care Co Insurance along with also other Co Payments

• Part A Deductibles

• Preventive care Co Insurance policy

• Part B Co-insurance along with Co-payment policy

• Extra rates of Part B

• Charge of three pints of blood to get medication therapy

• Skilled Nursing Facility care Co Insurance coverage

• Australian travel emergency policy around the limit of this plan

The Plan G Medicare Insurance Policies would be the only Product in the market which covers 100% of Part B excess expenses. Excessive charges are paid out once physicians and providers don’t accept that the Medicare assignment. In such situation, a physician charges the patients significantly more than authorized amount in Medicare. Minus the Strategy G Medicare insurance, most patients are responsible for spending the excess fees out in their account. But Medicare Supplement Plan G pays off these expenses for you personally. Anyway, specific is also eligible for overseas travel crisis policy below the plan which covers emergency wellbeing costs outside their residence country.

Don’t do these mistakes on your retirement

Sure, That there are some things you will need to learn just before you retire. Because many people create some fundamental errors while going to their own retirement. Usually, it is hard when someone creates a mistake while creating their retirement program. In times of challenge, this issue may become bigger.

In This article, we’ll talk about some common and general high priced mistakes that you need in order to prevent to own an ideal retirement plan.

Don’t Escape from the market

In case The market goes with a reduction, but don’t step backwards . If you decide to sell your investments at the retirement portfolio of yours, then you likely may overlook out the opportunity when the market will possess a comeback.

Take each benefit from the Retirement accounts

When Your boss offers you a donation program, you need to try to provide just as far as you’re able to. There is going to be free money to choose, of course should that you don’t contribute, you’re enabling the money go.

Do not purchase many shares from the Corporation

Just as You’re getting retired in a few days, you shouldn’t devote any sum of one’s retirement savings.

Borrowing cash from the retirement Plan is insecure

If Your retirement savings are somewhat smaller, so you also must not consider any loan out of it. You will lose a few benefits within the practice. It’ll stop the possible investment growth of one’s program.

Think about the cost of retirement

By Age 65, even in the event you choose to retire, then you will get to devote a lot in retirement. You want to believe and spend so. When you opt to find yourself a Medicare supplement plans 2021‘, consider the expenditures to this issue as well.

Do not Neglect to stay at heart about your taxes. If you borrow or withdraw some fund by your retirement savings, you will have to pay taxation for that